Facturen, belastingen en EU BTW

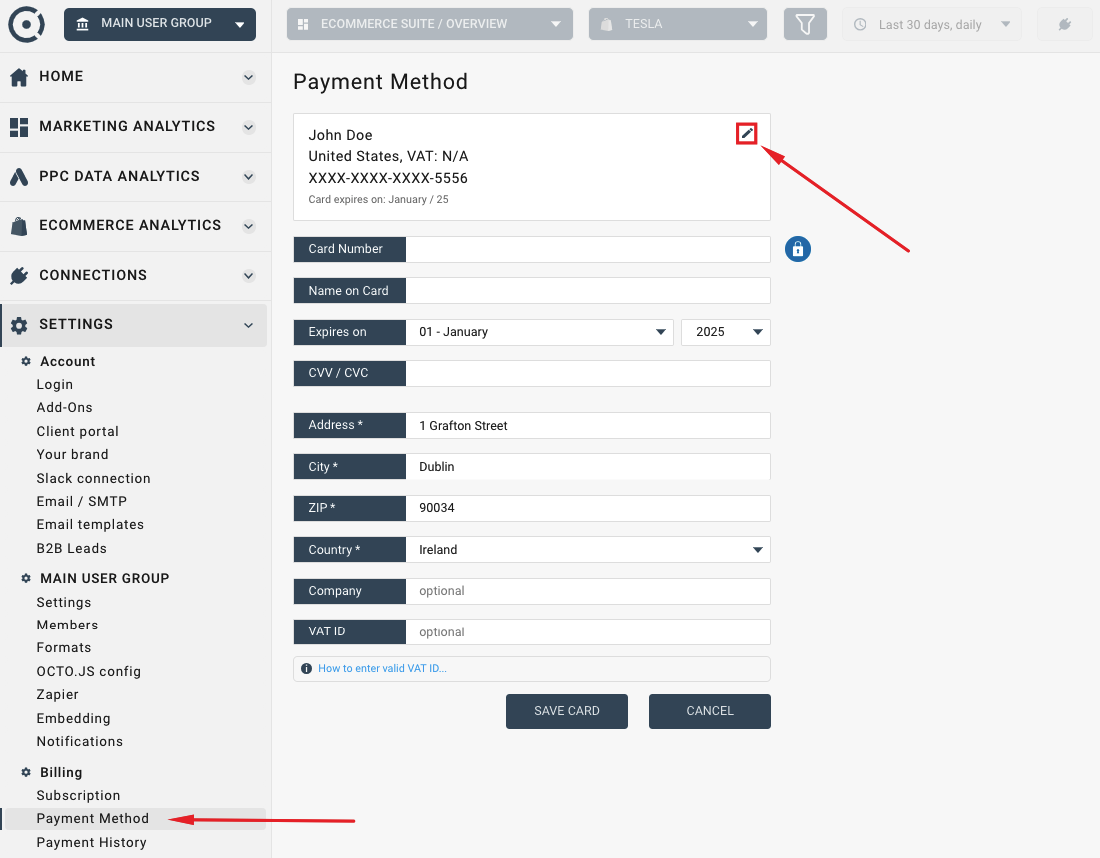

Om een betaling te doen, moet u uw creditcard toevoegen aan uw Octoboard-profiel. De kaart wordt gevalideerd en BTW wordt correct toegepast.

Octoboard is een in de EU gevestigd bedrijf. Klanten buiten de Europese Unie worden geen EU-BTW in rekening gebracht. We zijn ook geregistreerd voor BTW bij HMRC en innen 20% BTW op alle verkopen in het Verenigd Koninkrijk.

We passen Europese BTW-tarieven toe op alle aankopen die door particulieren in de EU worden gedaan. Europese bedrijven moeten bedrijfsnamen en geldige BTW-identificatienummers invoeren. We zullen de gegevens valideren en in dat geval geen BTW in rekening brengen (behalve voor bedrijven gevestigd in de Republiek Ierland). Als de verificatie van uw BTW-identificatienummer mislukt, wordt BTW toegepast en betaald aan uw nationale belastingdienst.

Zorg ervoor dat u de juiste EU BTW-ID invoert, inclusief landcode (bijv. DE 999999999 in Duitsland). Gebruik alstublieft https://ec.europa.eu/taxation_customs/vies/ om te controleren of uw BTW-ID geldig is.

EU BTW-tarieven (belast of vrijgesteld) worden aangegeven op Octoboard BTW-facturen. Elke gegenereerde factuur wordt opgeslagen in ons systeem. Ga naar LINKERMENU > ACCOUNT > BETALINGSGESCHIEDENIS om ze te vinden.

Klanten in de Republiek Ierland (bedrijven en particulieren) worden 23% in rekening gebracht. Britse klanten worden 20% in rekening gebracht.