Fatture, tasse e IVA dell'UE

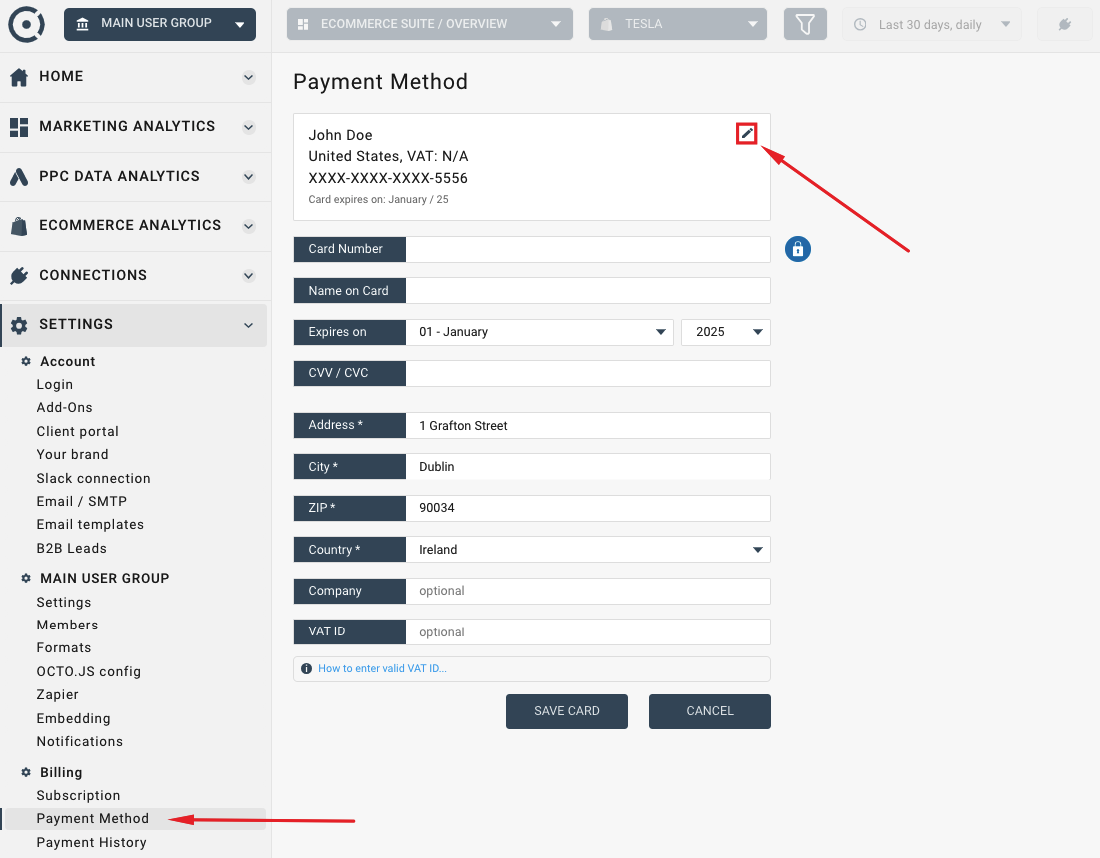

Per effettuare un pagamento, devi aggiungere la tua carta di credito al tuo profilo Octoboard. La carta verrà convalidata e l'IVA verrà applicata correttamente.

Octoboard è un'azienda con sede nell'UE. I clienti al di fuori dell'Unione Europea non saranno addebitati l'IVA dell'UE. Siamo anche registrati per l'IVA presso l'HMRC e riscuotiamo il 20% di IVA su tutte le vendite nel Regno Unito.

Applicheremo le aliquote IVA europee a tutti gli acquisti effettuati da privati nell'UE. Le aziende europee dovrebbero inserire il nome dell'azienda e i validi ID IVA. Convalideremo i dati e in quel caso non addebiteremo l'IVA (ad eccezione delle aziende con sede nella Repubblica d'Irlanda). Se la verifica del tuo ID IVA non riesce, verrà applicata l'IVA e pagata all'autorità fiscale nazionale.

Assicurati di inserire correttamente l'ID IVA dell'UE incluso il codice del paese (es: DE 999999999 in Germania). Utilizza https://ec.europa.eu/taxation_customs/vies/ per verificare se il tuo ID IVA è valido.

Le spese IVA dell'UE (addebitate o esenti) sono indicate nelle fatture IVA di Octoboard. Ogni fattura generata sarà archiviata nel nostro sistema. Visita MENU DI SINISTRA > ACCOUNT > STORICO PAGAMENTI per trovarle.

Ai clienti nella Repubblica d'Irlanda (aziende e privati) verrà addebitato il 23%. Ai clienti del Regno Unito verrà addebitato il 20%.