Invoices, taxes and EU VAT

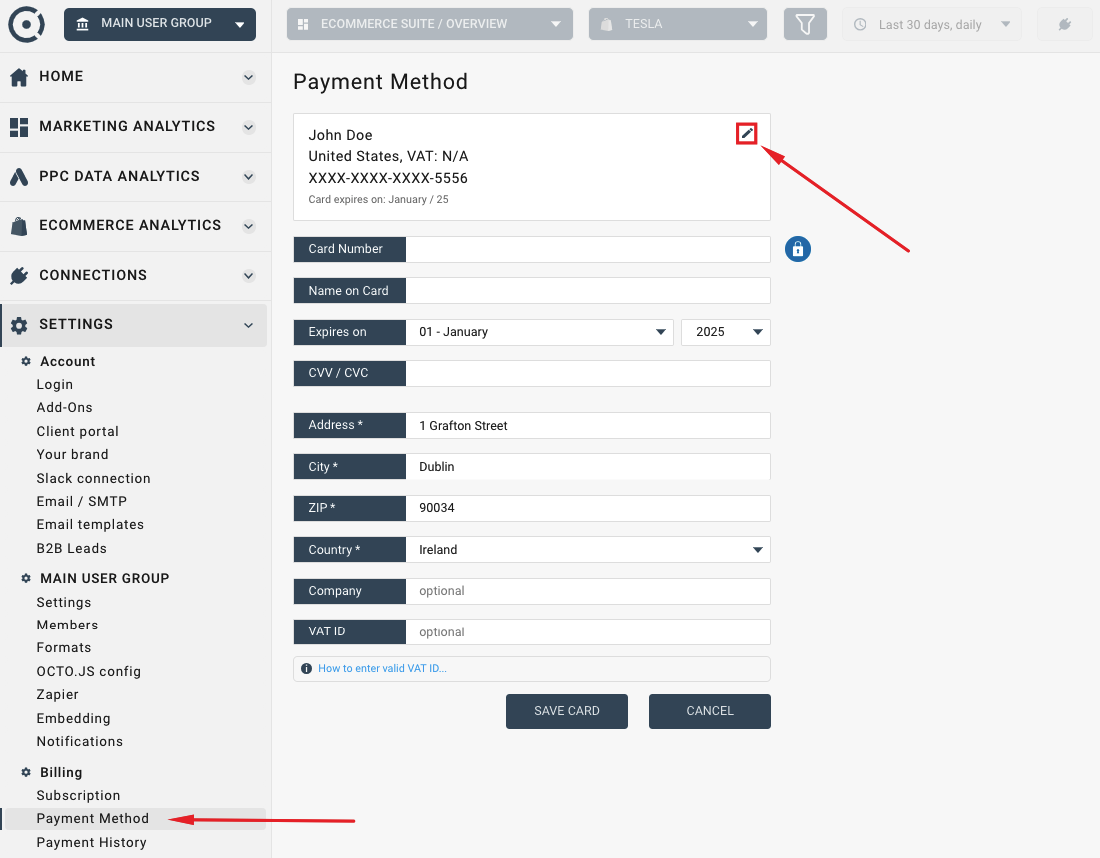

In order to make a payment, you have to add your credit card to your Octoboard profile. The card will be validated and VAT correctly applied.

Octoboard is an EU-based company. Clients outside of European Union will not be charged EU VAT. We are also registered for VAT with HMRC and collect 20% VAT on all UK sales.

We will apply European VAT rates to all purchases made by individuals in the EU. European companies should enter business names and valid VAT IDs. We will validate the data and will not charge VAT in that case (except for businesses based in the Republic of Ireland). If your VAT ID verification fails, VAT will be applied and paid to your national tax authority.

Make sure you enter correct EU VAT ID including country code (ex: DE 999999999 in Germany). Please use https://ec.europa.eu/taxation_customs/vies/ to check if your VAT ID is valid.

EU VAT charges (charged or zero rated) are indicated in Octoboard VAT invoices. Every generated invoice will be stored in our system. Visit LEFT MENU > SETTINGS > ACCOUNT > PAYMENT HISTORY to locate them.

Customers in the Republic of Ireland (businesses and individuals) will be charged 23%. UK customer will be charged 20%.